Introduction

As of July 1, 2022, eInvoicing became mandatory in Vietnam under Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP. To comply with these regulations, businesses must submit e-Invoice data to tax authorities either directly or through authorized providers like Viettel, VNPT, BKAV, and MISA.

EInvoices must be in Vietnamese, with optional foreign language translations in parentheses. Data transmission must be in XML format. Importantly, The delivery note cum internal transport slip is a document that is printed, issued, used, and managed like an invoice.

To simplify this process, Ekino Vietnam has created an API Connector (eTool) for Sage X3, facilitating seamless integration with authorized e-Invoice providers. Ready-to-use connectors are available for Viettel, VNPT, BKAV and MISA, with custom development options for other providers. This solution ensures compliance while streamlining e-Invoicing processes for businesses using Sage X3.

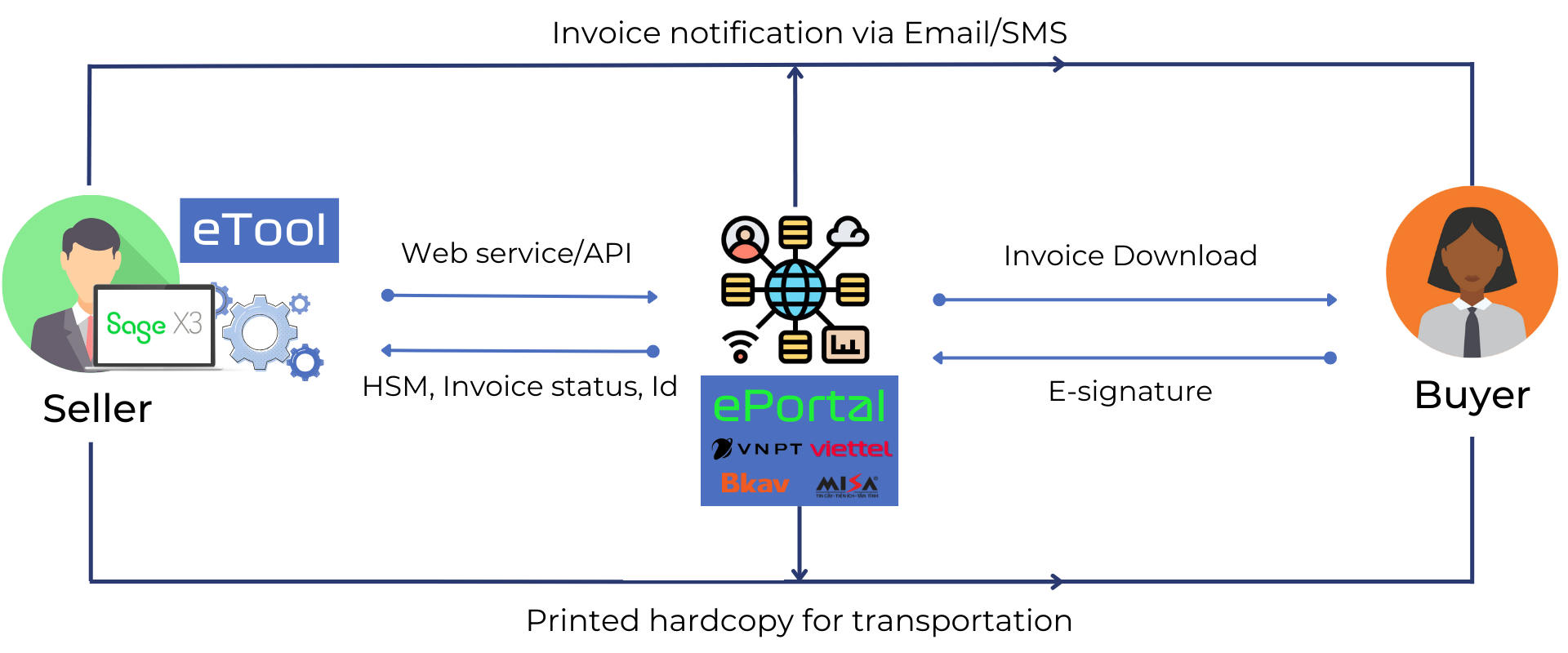

Intergration flow with external einvoice providers

Legal Compliance:

- Sellers are encouraged to choose an authorized third party for eInvoice publication as specified by Decree 123 and Vietnam law.

- The selected eInvoice provider will offer a Web Portal (ePortal) where buyers can view and download eInvoices.

API Connector (eTool):

- Ekino Vietnam’s API Connector (eTool) enables Sage X3 to connect with authorized eInvoice providers via web services/APIs.

- Ready-to-use connectors are available for Viettel, VNPT, BKAV, and MISA. Custom development may be necessary for other providers.

Invoice Processing:

- Invoices entered in Sage X3 can be sent to the eInvoice solution for publication.

- The solution will apply an electronic signature using an HSM (Hardware Security Module), update the invoice status, and publish it on the ePortal.

Buyer Interaction:

- Buyers can view and download eInvoices and eDelivery Notes from the ePortal after receiving notifications via email/SMS or a hard copy from the seller.

- Buyers may return documents with an electronic signature if required. Credit notes and eDelivery Notes are also considered types of invoices.

Ekino Vietnam holds intellectual property rights for the Vietnam eTool package, which includes all settings, configurations, and report templates to ensure compliance with electronic invoice regulations as outlined in Decree 123/2020/ND-CP.

For more information, user guide or demo of eTool for Sage X3 by Ekino Vietnam, contact us today