Ekino Vietnam has officially released version 2.2.3 of the Vietnam Legislation Pack for Sage X3. With V2.2.3, the report library now includes a detailed accounting book with corresponding entries report. This is a new step forward in improving the efficiency of financial management for businesses using Sage X3 in Vietnam.

What is a detailed accounting book with corresponding entries?

A detailed accounting book is used to record economic and financial transactions related to accounting objects that need to be monitored in detail according to management requirements. The data in the detailed accounting books provides information for the management of each type of asset, source of capital, revenue, and expenses that have not been reflected in the journal. The number and structure of detailed ledgers are not mandatory.

The special feature of this book is that each transaction is recorded simultaneously in two corresponding accounts, clearly showing the relationship between the accounts and ensuring accuracy and transparency in accounting.

For example, when you pay a purchase invoice in cash, the detailed accounting book with corresponding entries will record a decrease in the “Cash” account and an increase in the “Purchase expense” account.

Enterprises need to base on the State’s guidance on detailed books to design appropriate templates for use in their units. Detailed accounting books are recorded for each account.

Why is a detailed accounting books with corresponding entries important?

- Transparency and accuracy: All transactions are clearly recorded, making it easy for you to track economic transactions.

- Error detection: Thanks to the corresponding mechanism, detecting errors in records becomes easier.

- Compliance with regulations: The detailed account ledger with corresponding entries is an important part of the standard accounting system, ensuring that businesses comply with legal regulations.

Benefits of upgrading to Vietnam Legislation 2.2.3 for Sage X3 by Ekino Vietnam

With the detailed accounting book with corresponding entries report, Vietnam Legislation 2.2.3 brings outstanding benefits to your business:

- Accountants can easily check and reconcile with the general ledger

- Support auditing, easily check and verify financial accounting transactions

- Provide detailed and accurate information for preparing financial statements and tax reports.

How to export the detailed accounting book with corresponding entries report in Sage X3

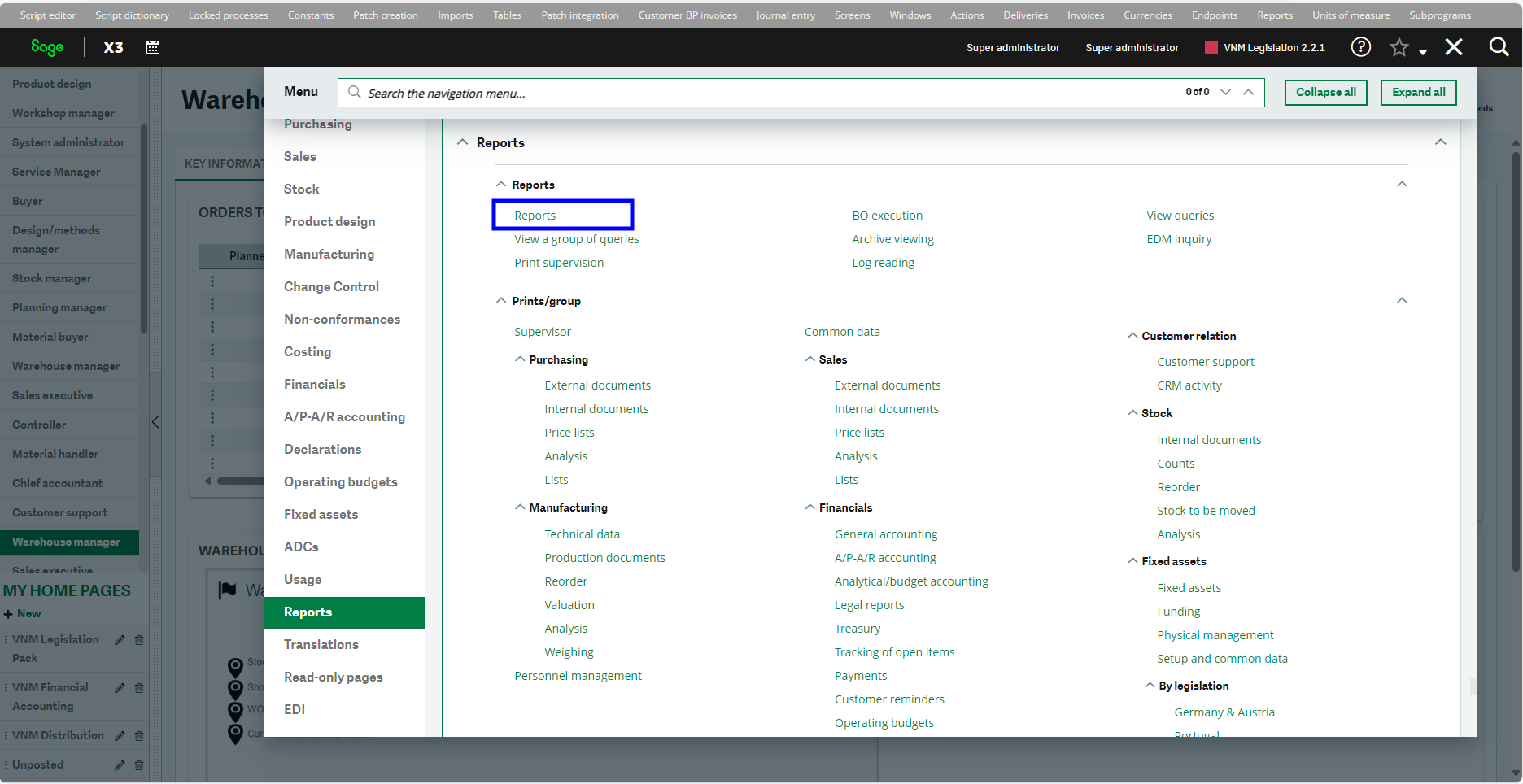

1. Access the Report module: From the Sage X3 home screen, select the “Report” module.

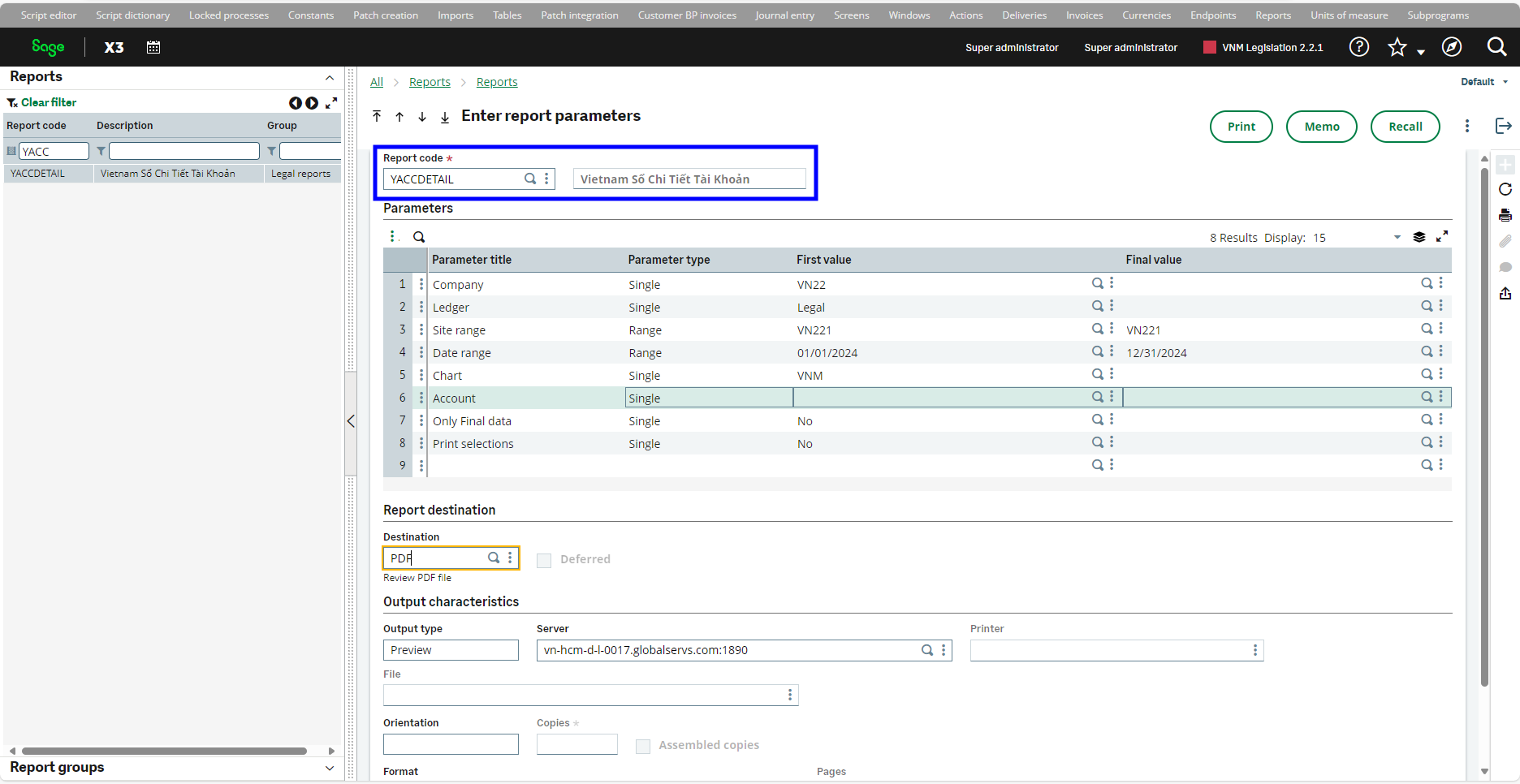

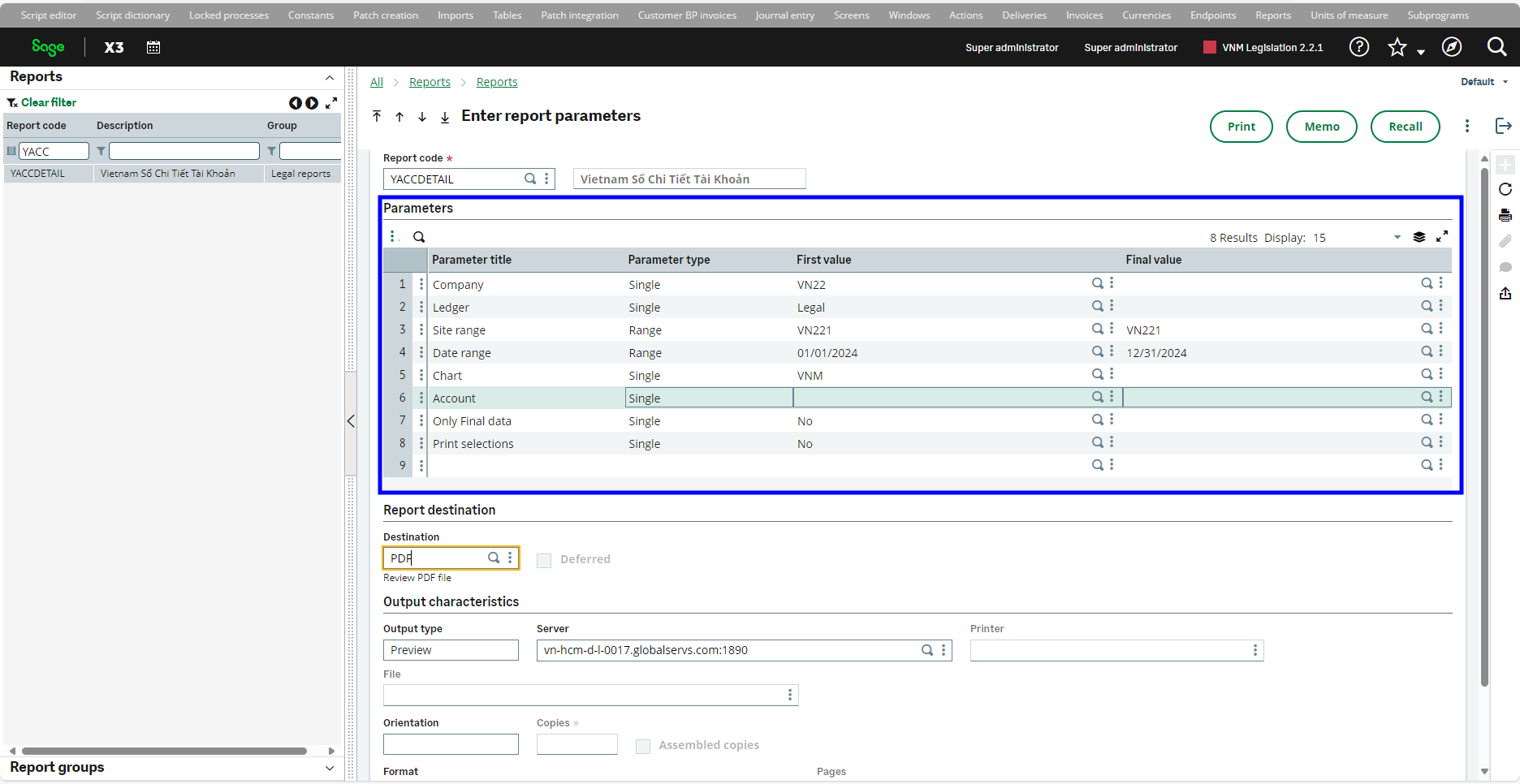

2. Select report: In the “Report” section, enter the report code “YACCDETAIL”

3. Enter parameters: such as company, account number, date,…

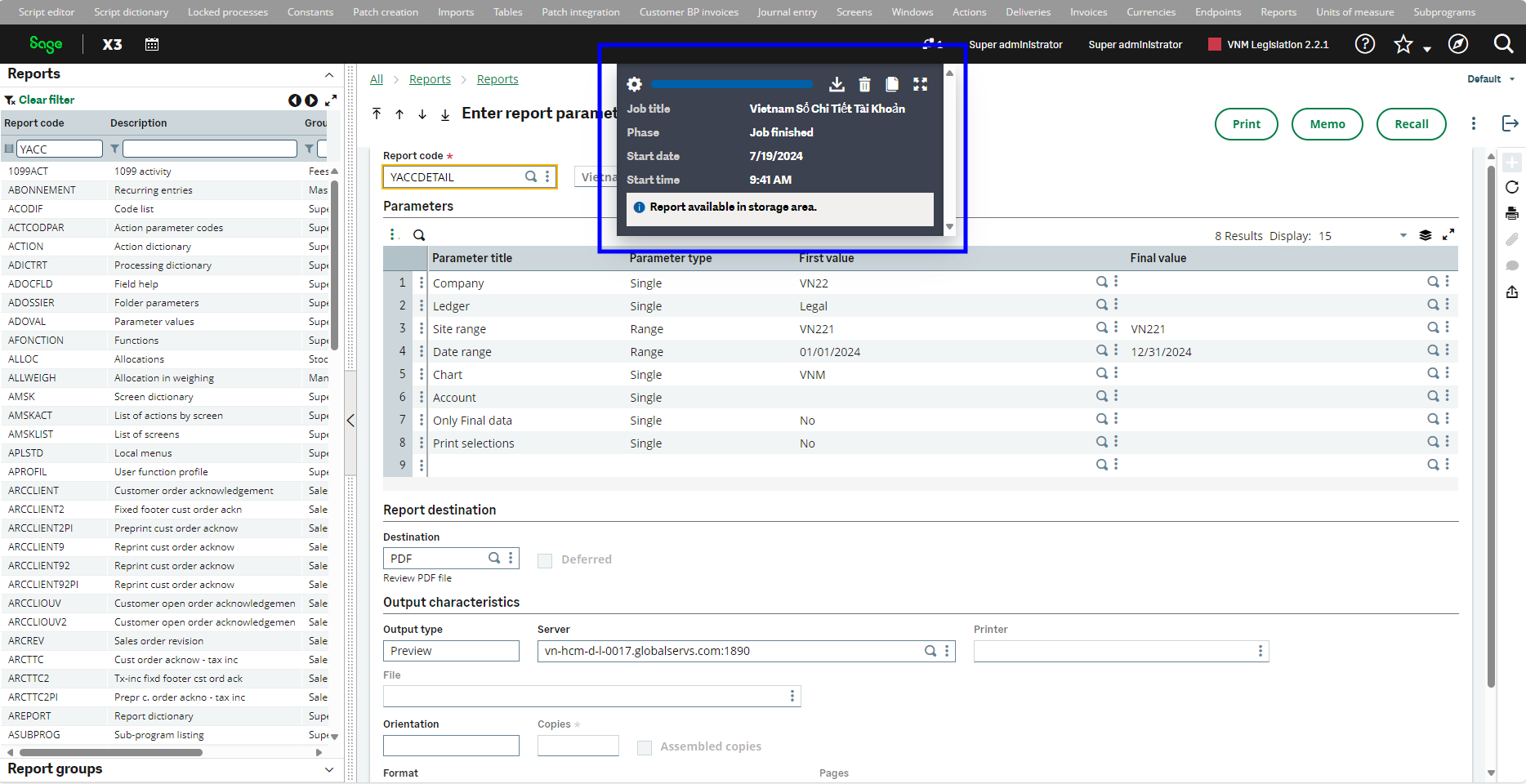

4. View and export report: After entering the parameters, you can view the report and export it as an Excel or PDF file.

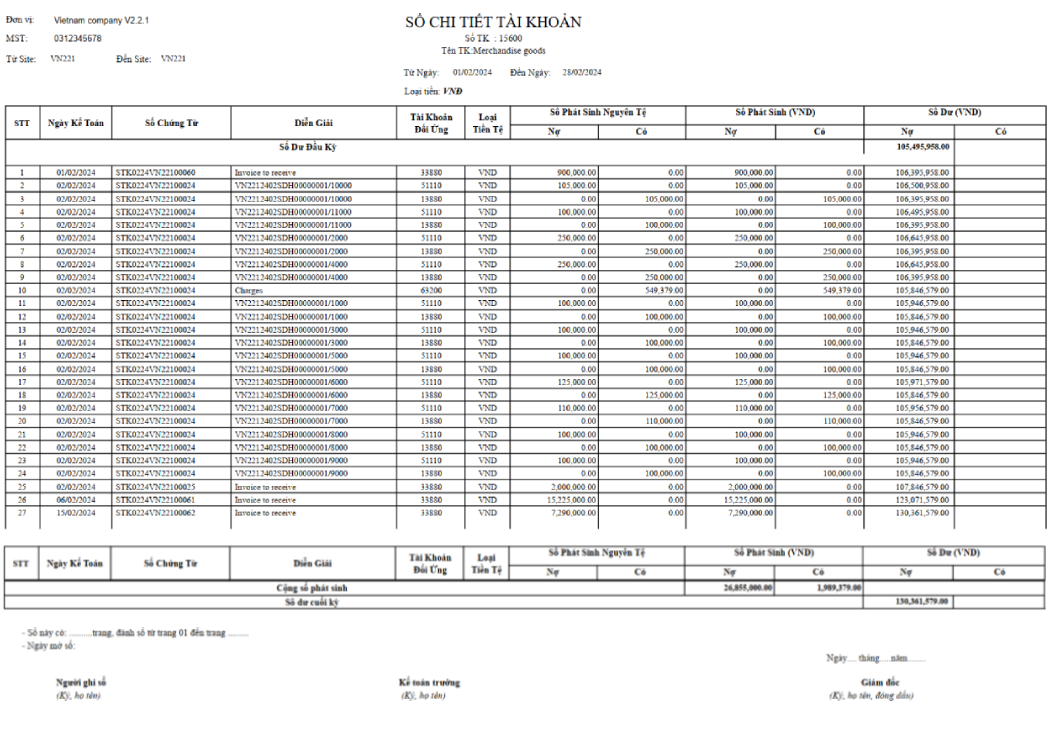

A sample of detailed accounting book with corresponding entries report:

For more information about Sage X3 and the latest updated Vietnam Legislation pack, contact Ekino Vietnam today.